U.S. chip stock market value evaporates over $500 billion, NVIDIA plummets by $2

On July 18th, TSMC's stock price in Taipei fell by more than 4%. TSMC is set to announce its Q2 results on Thursday, with analysts expecting a 30% increase in profits for the second quarter.

The decline in Asia-Pacific chip stocks continued the previous day's downturn in U.S. stocks. On July 17th local time, U.S. semiconductor companies' stock prices plummeted collectively, with a total market value loss of over $500 billion. The Philadelphia Semiconductor Index plummeted by 6.8%, marking the worst trading day since 2020. However, benefiting from the boom in AI, the index has still risen by 30% year-to-date.

At the close, Nvidia's stock price fell by 6.6%, with its market value evaporating by $205.9 billion overnight, equivalent to approximately 1495.1 billion yuan. TSMC's stock price fell by nearly 8%, Qualcomm's stock price fell by 8.6%, and AMD's stock price fell by over 10%. Advanced semiconductor equipment suppliers Applied Materials and Lam Research saw their stock prices fall by more than 10%, and Dutch lithography equipment manufacturer ASML's stock price in the U.S. plummeted by nearly 13% that day.

However, among all U.S. chip companies, Intel's stock price rose instead of falling. At the close, the company's stock price increased by over 1%.

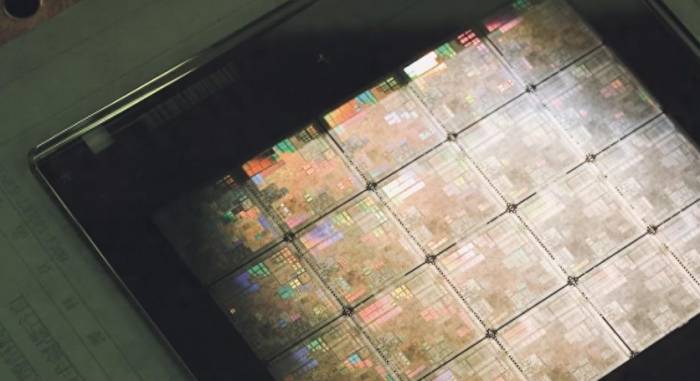

Intel is working hard to expand its wafer manufacturing capacity and build more chip foundries in the United States. Data from the Semiconductor Industry Association predicts that by 2032, the domestic chip manufacturing capacity in the U.S. will triple, with the potential to produce 30% of the world's advanced process chips.

Currently, TSMC remains the world's largest chip foundry, with major technology companies such as Apple and Nvidia being TSMC's clients. TSMC is also investing tens of billions of dollars in building new factories overseas, including $65 billion to build three factories in Arizona, USA.

Despite Intel's close pursuit of TSMC, Intel's wafer business continues to suffer losses. Intel's recently released financial report shows that the company's foundry division lost $2.47 billion in the quarter ending March 30th, and the wafer division lost $7 billion in the whole of last year.

Gartner analyst Sheng Linghai told reporters from Yicai that, "Intel is still very committed to doing IDM 2.0, but their latest chips are being manufactured at TSMC."

He explained that IDM 2.0 is a new strategy launched by Intel in recent years, aiming to achieve a strategy that combines foundry and advanced processes through multi-dimensional investments in wafer manufacturing, packaging, chiplets, software, and other areas.

Post Comment